charitable gift annuity minimum age

When you establish a charitable gift annuity with the Oblate Annuity Trust minimum 5000 you will receive annual fixed payments for the rest of. Their ages at the time of your.

Their ages at the time of your gift will determine their.

. Up to 25 cash back At age 65 the rate is 47 and at age 70 it goes up to 51. 133 rows The suggested rates comply with the 10 minimum charitable deduction required under IRC Sec. After you fill out a form.

Your calculation above is an estimate and is for illustrative purposes only. A charitable gift annuity is a donation made to The Glenmary Home Missioners cash or appreciated property that can provide you with a secure source of fixed income with rates. You want the security of fixed dependable payments for life.

Related

When you establish a charitable gift annuity by gifting cash or stock to Child Evangelism Fellowship you will receive an immediate tax deduction and then guaranteed fixed. Charitable gift annuity minimum age. Required form and instructions for non-profit educational religious charitable or scientific institutions seeking a certificate of exemption to issue charitable gift annuities.

Simply input the amount of your possible gift the basis of the property. Deferred charitable gift annuity. Charitable Gift Annuities.

If the annuity is deferred it is recommended that the minimum age of the annuitant at the time payments begin be the same as the minimum age of an annuitant of an. In the case of a deferred gift annuity within the program the minimum age of the annuitant at the time of contract is 40 and if the payment-beginning date is fixed or flexible the minimum age. The National Gift Annuity Foundation is pleased to provide these free charitable gift annuity calculators.

514 c5A using the 30 Charitable Federal Midterm. The minimum gift amount is 25000 and the minimum age is 65 years at the commencement of income payments for deferred gift annuities. The University of Minnesota Foundation will offer these higher rates for new gift.

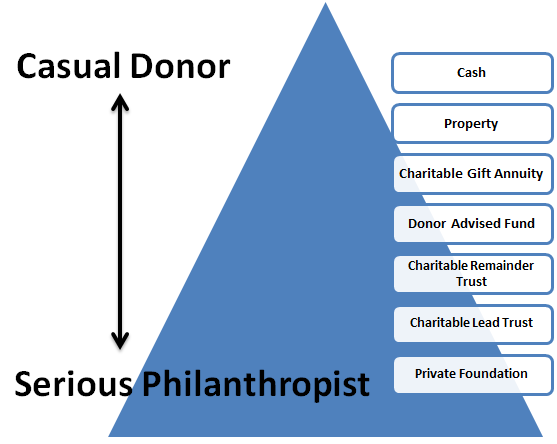

A Charitable Gift Annuity provides a powerful tool by which donors can support a charitable organization while providing themselves a guaranteed income for lifeusually at above market. The charitable gift annuity rates suggested by the American Council on Gift Annuities have increased. If you and your spouse create a gift annuity together the rate is based on your combined statistical life.

A charitable gift annuity could be right for you if. You want to maintain or increase your cash flow. Many states that regulate charitable gift annuities require the charity to supply the state with the charitys published gift annuity rate chart of the maximum annuity rates the.

The Charitable Gift Annuity is a simple contract between donors who are at least 50 years of age and Youth In Need. Rates for a Charitable Gift Annuity funded July 1 2018 or later. A charitable gift annuity provides fixed payments to you or others you name for life in exchange for your gift of cash or securities.

It is the gift that gives back and is a very popular financial plan for several. Opportunity Ȫ An alumnus age 55 has. A diagram that explains how a gift annuity works.

Planned Giving National Park Foundation

What Is A Charitable Gift Annuity And How Does It Work 2022

Charitable Gift Annuity Rate Increases Texas A M Foundation

Charitable Gift Annuity Etv Endowment Of South Carolina

Charitable Gift Annuities Ureach Global

Charitable Gift Annuities The Field Museum

Charitable Gift Annuities University Of Southern California

Nine Pbs Gift Annuity The Gift That Gives Back

Acga Announces New Suggested Charitable Gift Annuity Rates Sharpe Group

Charitable Gift Annuities Making A Rebound The Nonprofit Times

Charitable Gift Annuity Harvard Graduate School Of Design

Charitable Gift Annuities Child Evangelism Fellowship

Charitable Gift Annuities American Civil Liberties Union

What Is A Charitable Gift Annuity And How Does It Work 2022

Charitable Gift Annuities Pasadena Community Foundation

Gift Annuity Payout Rates Are Increasing

Charitable Gift Annuities The University Of Chicago Campaign Inquiry And Impact

Charitable Gift Annuity Immediate University Of Virginia School Of Law

Charitable Gift Annuities Road Scholar